How Billing Software Can Help You Keep Tax Calculations Compliant

In today's fast-paced business world, it has become very challenging for businesses of all sizes to keep in compliance with regulations and tax laws. Tax codes and regulations are constantly evolving and tend to change with time, becoming increasingly complex and difficult to monitor. Even slight errors in tax calculation can lead to worst financial costs accompanied by several legal issues when one fails to comply with the law. Fortunately, billing software has made it possible to handle the calculation of tax for businesses in a more valuable way, assuring compliance, saving one precious time, and reducing one's stress.

Here is the break down of how the billing software can help ease tax compliance to protect your business and help you grow rather than whining about the need for financial accuracy.

1. Automated Tax Calculation Minimizing Human Error

Another significant advantage of tax compliance billing software is that it can be utilized for automatic calculations of taxes. Tax rates vary depending on location, type of product, and jurisdiction, which tend to change frequently. This makes manual calculation of taxes prone to mistakes caused by human error, which may result in wrongly collected taxes from customers.

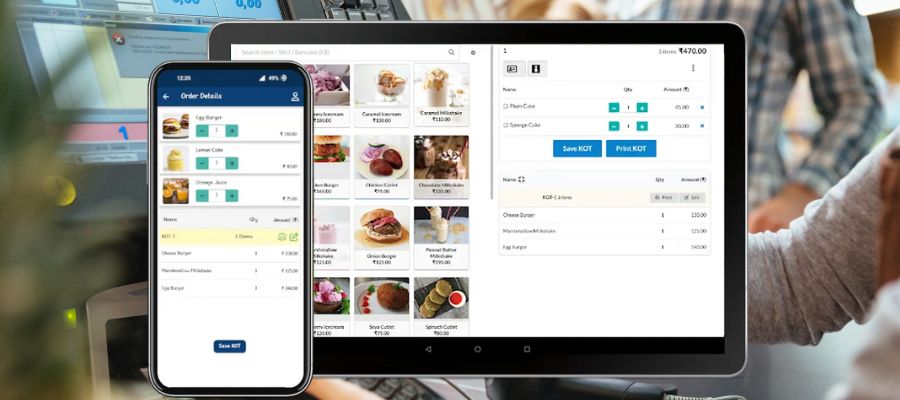

Billing software can automate all this, so it will actually apply the proper tax rate to each transaction in real time. You would be able to set up regional and industrial rules through software so that taxes may be computed automatically on every invoice with no manual interference. Thus, billing software reduces the inaccuracies in charges for tax and helps to avoid penalties for non-compliance.

2. Real-Time Tax Updates: Adjustments to Evolving Laws

Tax laws are dynamic. Every year, new tax rules may come into effect, and it can be becoming more challenging to keep up with recent changes. Failure to comply with the updated rules can jeopardize your business against non-compliance; instead, your business may face a legal or financial setback.

Many billing software providers include in their package real-time updates regarding tax rates as according to new laws. This real-time updating feature will thus ensure that you are applying the most current tax information at all times. Be it tax rates changes in local, state, or federal; your billing software shall apply the appropriate rates without trying to keep with the manual tracking of each regulatory update. It happens to be a feature which may effortlessly save a business hours of research and reconfiguration whereby ensuring compliance within an ever-changing tax landscape.

3. Easy Tax Documentation: Simplifying Record-Keeping

For instance, the tax payment is one aspect of tax compliance, while keeping a record in an accurate manner is a different aspect of it. Businesses are usually asked to keep all invoices, bills, bank statements, and other documents involving all transactions including the collected tax, as these have to be eventually presented before the tax offices for auditing. Moreover, paper-based documentation is difficult to manage and is likely to have errors and missing information that can result in compliance failure.

Bilking software keeps your business highly organized: it automatically prepares and maintains invoices, payment records, and tax details all within one central system. The relevant documents will be quickly available during an audit and the information will be right and up-to-date; besides, many billing software applications already have reporting tools that may also be customized to cater to your needs so you can get detailed tax reports by simply clicking a mouse button. This level of organization makes tax returns to be quite easy and gives one comfort, knowing that every document required is in hand and at their discretion.

4. Advanced reporting capabilities: Gain insights for better decision-making

Beyond record-keeping, the capabilities of advanced reporting in billing software give you meaningful depth into your business's tax-related finances. Several platforms give you detailed reports on sales tax, value-added tax, and many other relevant tax metrics over any given time period. This, therefore, allows you to monitor trends, keep track of compliance in real-time, and prepare for tax season with less stress.

Secondly, the information on such reports allows a company to understand when it has overcharged or undercharged taxes and, therefore, change books appropriately not to fall into noncompliance. For instance, if you realize that one place has increased tax difference then maybe that is a call for increasing tax rates or that one needs to train more about your workforce on how to handle certain types of tax when it comes to operating in that region. Such insights, aside from ensuring that all books are placed correctly from the compliance standpoint, improve operational efficiency generally.

5. Multi-jurisdictional compliance: Managing complexity across borders

For a company with business operations in more than one state or country, tax compliance enters the realm of complexity. Every state and country has its different tax rates, exemption rules, and reporting requirements. No one even attempts to follow up on all this with administrative book-keeping.

Billing software makes the multi-jurisdictional compliance process easy as it allows you to set particular tax rules based on location. Many software solutions come with features to manage tax compliance across borders, which includes sales tax, VAT, even on GST for international markets. It gets the company out of the complicated tax compliance logistics, helping it focus on growth and expansion. Now it could be the trusted EU VAT compliances or U.S. state sales tax laws, billing software can be very indispensable for international operations.

6. Exemption Management: Customized to Business-to-Business Applications

Some businesses or their products qualify for exemption upon taxes; therefore, the failure to apply exemptions appropriately may result in overpayment of taxes or fines. Billing software will automatically manage exemption certificates, accurately apply them and document the exemptions on the related tax returns.

Most billing software packages also allow you to import and store exemption certificates from qualifying customers, whether nonprofits or government agencies. This way, you can automatically factor this information into the calculation of any taxes, so that you do not collect incorrect amounts from exempt customers. Further, keeping these exemption records ensures that there is a paper trail ready in case of an audit, showing that you have followed tax laws.

7. Audit Preparedness: Accuracy and Readiness in Case of an Audit

Being audited can be quite stressful, especially when your records are all over the place or incomplete. The billing software prepares and makes available transaction and tax data that is centralized, organized, and ready for an audit. Because every transaction is captured with precision and supported by invoices and tax documents, you can quickly produce all the necessary information when an audit arises.

Some advanced billing software solutions feature an "audit trail." It keeps track of all changes initiated in an invoice, rate, or even a series of transactions. This keeps the auditor satisfied while evidencing your business's capabilities to maintain proper tax compliance procedures. You are probably less likely to have some penalties spring up at you during some audit if you have set these kinds of safeguards beforehand.

8. Increased Consumer Confidence: Tax Charge Transparency

The benefits of the billing software are not only to your business but also to give more confidence to the customers. It calculates and clearly makes an entry of taxes on the bills so that the customers are well-informed about their charges. The clear transparency in taxation invoices reduces customer disputes over tax charges, thus creating a smoother transaction and strengthening the reputation of the business.

Customers appreciate businesses that seem professional, organized, and clear in communication regarding charges. Invoicing software helps present such clear itemized receipts that reflect the proper tax charge and instill confidence in the credibility of your business practices by customers. Experience in any business practice for years with integrity can be influential, making long-term relationships and loyalty to your business likely.

9. Scalability and Adaptability: Following Growth with Your Business

With the growth of your business comes the complexity of your tax obligations. Billing software is inherently scalable and will scale with the growth of your business without disrupting the efforts you are making at tax compliance. You might expand into new markets or introduce new products or open a new location; it's then that appropriate tax rules can automatically be applied by the software.

Most billing software programs have flexible packages, so a business can simply add the new features or jurisdictions as needed. This flexibility does not only keep you compliant with your changing business, but it also supports sustainable growth by avoiding costly, time-consuming tax adjustments later on.

10. Economies of Time and Compliance Cost Savings

Another reason why billing software should be adopted is that it results in cost efficiency. Errors in compliance, missed deadlines, and wrong tax filings attract penalties within a very short time. The correct calculation of the tax using billing software minimizes the occurrence of costly mistakes. The software also saves time and relevant resources meant for tax management through eliminating unnecessary manual calculations and paperwork.

It frees the resources that would otherwise have been spent correcting tax errors or managing audits to spend on growth-oriented initiatives. The saving from front-end billing software investment often far outweighs the initial cost, both financial and operational.

Conclusion: Staying Compliant and Competitive with Billing Software

It has turned into a complete intervention call with a focus to keep your business compliant as avoiding penalties, audits, and bad reputations can only be managed if you are integrated into tax regulations. Billing software has developed as an indispensable tool to automate tax calculations, keep updated with regulatory changes, organize tax documentation, and bring transparency among customers. Therefore, businesses can achieve tax compliance more efficiently, reduce operational costs, and build trust with their customers through the implementation of billing software.

Irrespective of the size, whether a small business or a big corporation, adopting billing software for tax compliance is a very smart investment that will ensure your financial accuracy supports your company's reputation. With these systems in place, your business can confidently face the complex and changeable tax environment—once we all dare to dream and negate the nightmare of tax season.